Menu

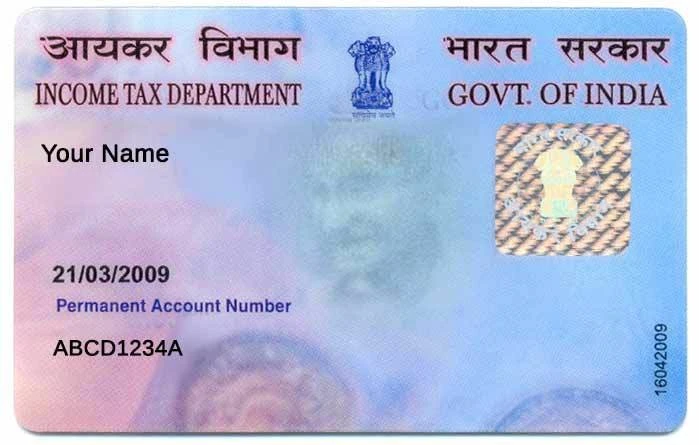

The establishment of Taxcure Consultancy LLP took place in the year 2017, where it offers consultancy services concerning the procurement of PAN Cards in India. Permanent Account Number (PAN) is generally required in different areas like account opening with banks, enrollment for VAT or Service Tax, and receiving interest from fixed deposits. People above the age of 18 years; male or female are well qualified to apply for PAN card.

Typically, it takes about 25 to 45 working days.

Taxcure Consultancy LLP, India's leading tax firm since 2017, delivers expert financial solutions with integrity, innovation, and compliance-focused strategies.

Doing the right things, in an independent, confidential, fair and ethical manner

We continually improve through listening, learning and innovation

Develop analytical and practical expertise in domain.

Working together with other professionals globally to achieve client's goals

Tailored solutions designed specifically for your unique needs.

Working together to unlock your business’s full potential.

Guiding your decisions with deep market expertise and foresight.

Always here, whenever you need us.

| Deductions Income | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1,500,000 | 1,625,000 | 1,875,000 | 2,125,000 | 2,375,000 | 2,625,000 | 2,875,000 | 3,125,000 | 3,250,000 | 3,500,000 | 3,750,000 | |

| ₹ 6,50,000 | Same | Old | Old | Old | Old | Old | Old | Old | Old | Old | Old |

| ₹ 7,50,000 | New | Same | Old | Old | Old | Old | Old | Old | Old | Old | Old |

| ₹ 8,00,000 | New | New | Same | Old | Old | Old | Old | Old | Old | Old | Old |

| ₹ 9,00,000 | New | New | New | Same | Old | Old | Old | Old | Old | Old | Old |

| ₹ 10,00,000 | New | New | New | New | Same | Old | Old | Old | Old | Old | Old |

| ₹ 11,00,000 | New | New | New | New | New | Same | Old | Old | Old | Old | Old |

| ₹ 12,25,000 | New | New | New | New | New | New | Same | Old | Old | Old | Old |

| ₹ 13,50,000 | New | New | New | New | New | New | New | Same | Old | Old | Old |

| ₹ 14,25,000 | New | New | New | New | New | New | New | New | Same | Old | Old |

| ₹ 15,00,000 | New | New | New | New | New | New | New | New | New | Same | Old |